Cryptocurrency license

The world of finance is evolving rapidly, with cryptocurrency being a leading force in this transformation. Understanding the intricacies of the crypto market, including the critical step of securing a cryptocurrency license, is key to thriving in this new landscape.

Understanding Cryptocurrency and Its Market Impact

Cryptocurrency has revolutionized the way we think about money. Its borderless, decentralized nature and the potential for high returns have attracted millions of investors worldwide. The market cap of cryptocurrencies exceeds trillions of dollars, signifying their mainstream acceptance and influence.

Why is a Crypto License Necessary?

Enhancing Trust

In a volatile market like cryptocurrency, trust plays a vital role. A crypto license signifies regulatory compliance and enhances trust among investors.

Regulatory Compliance

Operating within the legal framework ensures businesses are not subjected to penalties or legal consequences, which could be detrimental to their operations.

Speed

Easy

Legal

Guarantee

Different Types of Cryptocurrency Licenses

There are various types of licenses required to conduct different types of operations within the crypto space.

Crypto Exchange License

This license is a must-have if you plan to start a cryptocurrency exchange. It allows your platform to legally allow users to buy, sell, and exchange cryptocurrencies.

Cryptocurrency Broker License

A cryptocurrency broker license is needed to legally provide a platform where users can trade cryptocurrencies against fiat or other cryptocurrencies.

Crypto Trading License

The crypto trading license allows entities to legally engage in the business of trading cryptocurrencies.

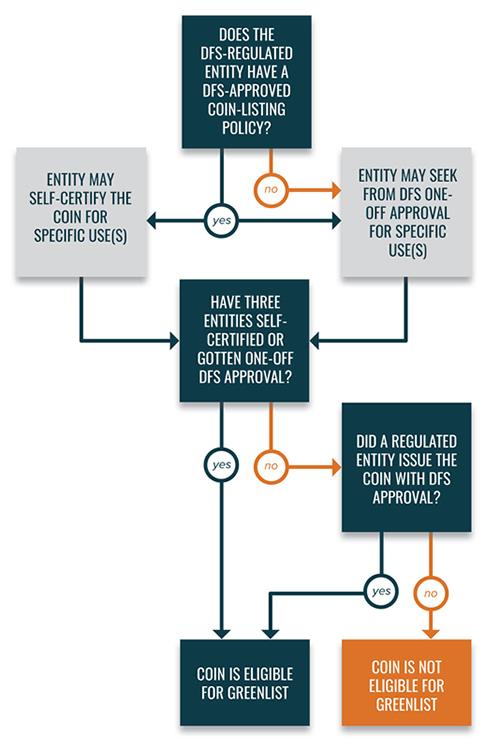

Virtual Currency License

Also known as a BitLicense, this is specifically designed for businesses that deal with digital currencies, including exchanges, wallets, and payment processors.

Process to Obtain a Cryptocurrency License

Securing a cryptocurrency license can be a complex process, often requiring legal assistance. It involves applying to the relevant regulatory body, fulfilling their stipulated requirements, and awaiting approval.

Cost Implications for a Crypto License

While the potential rewards in the crypto market are high, businesses must also consider the costs involved in securing a license. These include application fees, consultancy fees, and ongoing regulatory costs.

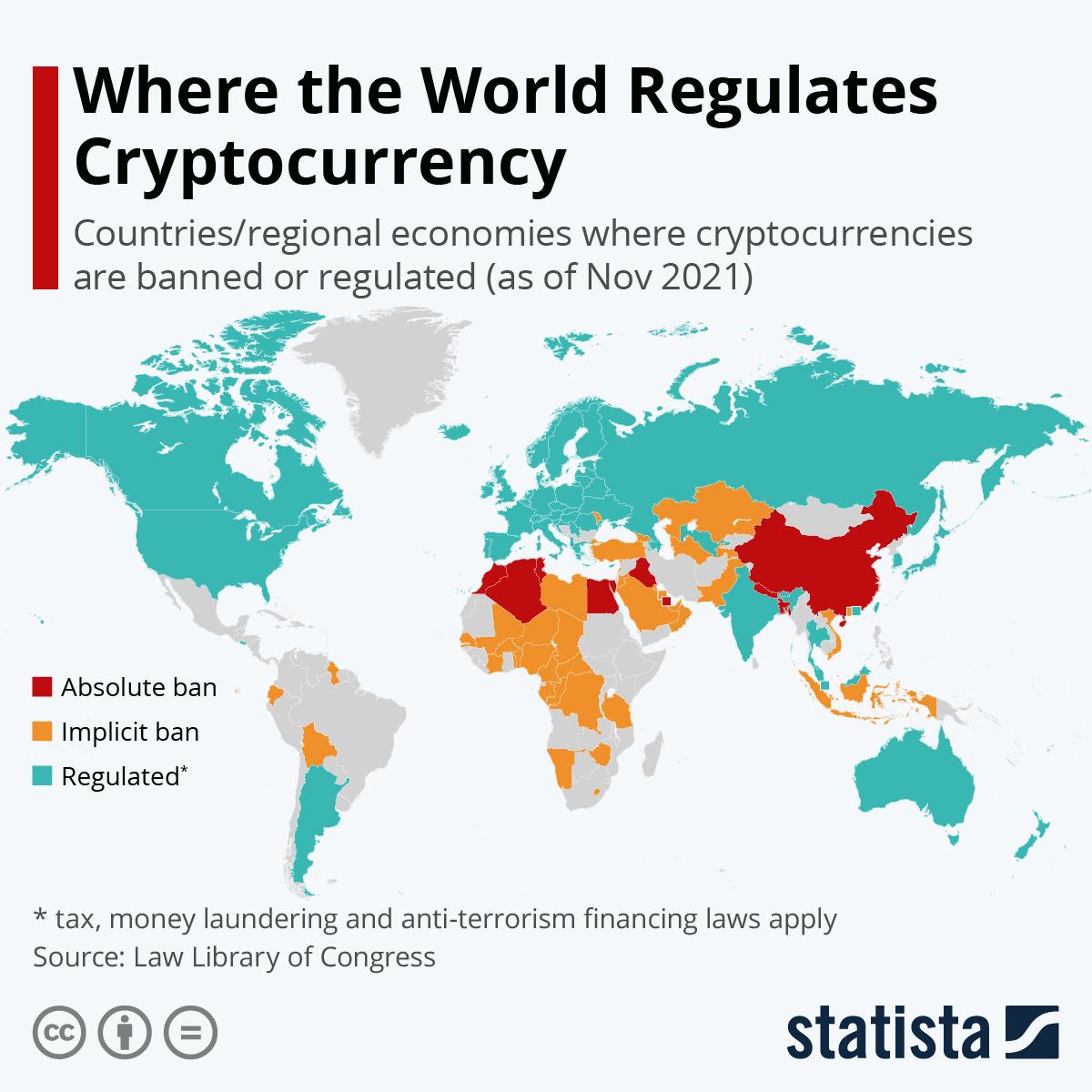

Legal Framework and Regulations around Cryptocurrency Licenses

As cryptocurrency gains popularity, regulations have been established to ensure its responsible use. Businesses must keep abreast of the legal developments to maintain their license.

Key Requirements for Cryptocurrency License

The requirements vary by jurisdiction and type of license but generally involve stringent checks on financial solvency, operational competence, and regulatory compliance.

How to Apply for a Crypto Exchange License

Applying for a crypto exchange license involves submitting an application with the necessary details, going through checks, and getting approval.

Securing a Cryptocurrency Broker License

Obtaining a broker license is similar but may involve additional checks on the trading platform’s security and reliability.

Process for Getting a Crypto Trading License

Getting a trading license involves demonstrating your trading expertise and the ability to comply with regulations.

Obtaining a Virtual Currency License

The process for getting a virtual currency license involves proving that your business has robust security measures and can protect customers' funds.

Common Pitfalls and How to Avoid Them

Common pitfalls include inadequate preparation and understanding of the regulatory requirements. Proper research, seeking expert advice, and thorough preparation can help avoid these pitfalls.

Crypto License in Europe

Europe is a favorable destination for crypto businesses due to its progressive regulations. The process for obtaining a crypto license in Europe is clearly defined, and many businesses have successfully obtained their licenses in the region.

Advantages of Having a Cryptocurrency License

Having a cryptocurrency license not only enhances trust among customers but also opens up opportunities for business expansion.

The Future of Cryptocurrency Licensing

As the crypto market continues to grow, the need for regulation will only increase. Businesses that proactively seek to comply with these regulations will be better positioned for success in the future.